Author: Drish Israni

The Allure of Investing in the Far East

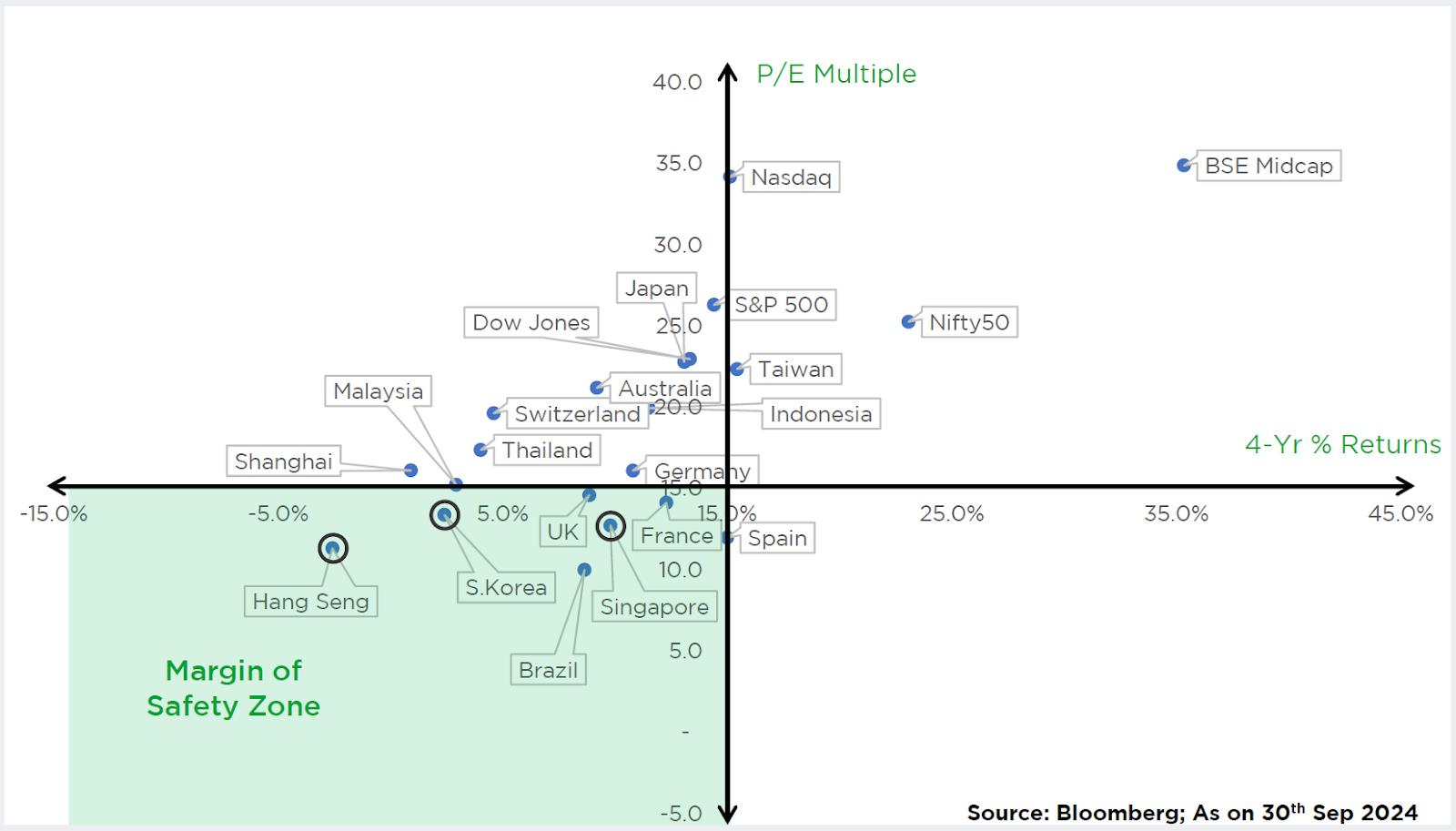

The Far East, a region synonymous with rapid economic growth and diverse opportunities, has long been a focal point for global investors. Within this dynamic landscape, China, the world’s second-largest economy, stands out with its immense growth potential and economic policies. As the global financial landscape adjusts post-pandemic, the Far East, led by China, presents a compelling case for diversification. With the China stock market near 25-year lows, upcoming stimulus packages, and a government focused on restructuring domestic consumption, investing in China offers a rare, multi-decadal opportunity.The Growth Potential of China’s Economy

China’s unparalleled economic growth has been fueled by its robust manufacturing sector, research & innovation, electric vehicle advancement, and government-backed initiatives.Key Government Policies

China’s central government has unveiled fiscal stimulus measures aimed at boosting domestic consumption and economic restructuring. The focus includes:- Increasing household spending power.

- Reshaping export-driven growth models towards domestic consumption.

- Investments in infrastructure and green energy sectors.