The recent downturn in India’s mid cap and small cap index has left investors and analysts alike searching for answers. Once the darlings of the stock market, these segments are now grappling with significant declines. But what has led to this sudden change in fortune? Is it merely markets falling, or are there deeper, systemic issues at play?

In this article, we delve into the factors contributing to this decline, exploring overvaluations, foreign investor sentiments, liquidity challenges, banking sector woes, technological competition from China, and signs of an economic slowdown.

Overvaluations in Midcaps and Small Caps – Comparing BSE Mid Cap Index & Small Cap Index Based on P/E Ratio

Historically, the Price-to-Earnings (P/E) ratio serves as a reliable indicator of market valuations. As of early March 2025, the BSE MidCap index’s P/E ratio stands at >30x, while the BSE Small-Cap index is at 28x. These figures are significantly higher than their long-term averages of 22.4 and 16, respectively. Such elevated valuations suggest that these segments are overpriced, making them less attractive to investors seeking value.

| Historic Avg. | Peak Sept ‘24 | March ‘25 | Notes | |

| BSE Mid Cap Index | 22.5x | 43x | 31x | Overvalued |

| BSE Small Cap Index | 16x | 32x | 28x | Significantly Overvalued |

Additionally, the market capitalization-to-GDP ratio, another critical valuation metric, has reached unprecedented levels. As of December 2024, India’s market capitalization stood at 136.4% of its nominal GDP, with the 25-year average hovering around 86%. This high ratio indicates that the market is overvalued relative to the country’s economic output; in fact, as of March 2025, this ratio is still ~110%. The lack of earnings growth to justify these high valuations has deterred foreign portfolio investors (FPIs) from deploying capital, further fueling the markets falling trend in the midcap and small-cap space.

Erosion of Margin of Safety for Foreign Investors

Foreign investors often assess the margin of safety before committing capital to emerging markets like India. Currently, the spread between Indian and U.S. bonds yield is at a nearly 2-decade low, resulting in a slowdown in foreign inflows into the bond market. Furthermore, with a depreciating rupee, foreign investors require returns exceeding 8% to justify the inherent risks of investing in Indian equity markets. Given the overvalued mid cap index and small cap index, achieving such returns becomes challenging. Consequently, capital has been flowing away from India to undervalued markets such as China and Europe, as well as high-growth sectors like technology in the United States. This shift is a key reason why the mid cap index and small cap index are falling in India.

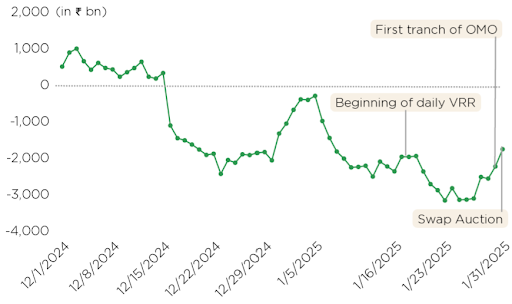

Persistent Liquidity Deficit

Since December 16, 2024, India’s financial system has experienced a continuous liquidity deficit. RBI had to interject & ease out liquidity with various OMO & VRR operations. To stabilize depreciating currency, RBI also conducted Fx-swaps which resulted in a record $77 bn net short dollar position as of Jan 31, 2025. Combined with further announced Fx-swaps of $25 bn in Feb-Mar 2025, these aggressive actions have tightened rupee liquidity. Persistent liquidity constraint has raised borrowing costs with corporate bond yields and CD rates remaining elevated. Further, spread between repo rate and corporate bond yield has widened to 125bps.

Challenges in the Banking and Financial Sector

The banking sector, particularly microfinance institutions, is under strain. Non-Performing Assets (NPAs) in the microfinance sector soared to ₹50,000 crore by the end of December 2024, representing a 13% ratio of gross loans. This surge in NPAs indicates rising defaults, leading banks to adopt more cautious lending practices. Consequently, midcap and small-cap companies, which often rely on bank financing, face difficulties in securing necessary funds for operations and expansion. This has further aggravated the markets falling.Advancements in Competing Markets

China’s rapid technological advancements have significantly shifted global investment dynamics, drawing attention away from Indian midcap and small-cap companies.- Artificial Intelligence (AI): China has outlined key policy priorities for 2025, emphasizing rapid advancements in AI development. The country aims to integrate AI into manufacturing and expand applications such as humanoid robots, reinforcing its position as a global leader in AI innovation. Notably, the emergence of Deepseek, China’s latest AI model, has intensified competition in the generative AI space, offering cutting-edge capabilities at a fraction of the cost of its Western counterparts.

- Electric Vehicles (EVs): BYD, China’s top EV maker, sold a record 4 million EVs in 2024, surpassing Tesla in total sales and solidifying its market dominance. The company has introduced the “God’s Eye” self-driving system across all its models, including the budget-friendly Seagull hatchback, making advanced autonomous technology accessible to a broader market and increasing its operating margin. As of today, China accounts for 60% of global EV sales and commands a more than 50% share in EV battery production.

- Renewable Energy: China has established itself as the undisputed leader in solar energy, dominating global solar cell production and photovoltaic (PV) manufacturing. In 2024, China accounted for over 80% of the world’s solar cell supply, with solar panel exports surging by 38% year-over-year. The country has aggressively expanded its solar capacity, adding nearly 200 GW of new solar installations in 2023, surpassing the combined solar capacity of the United States and Europe.

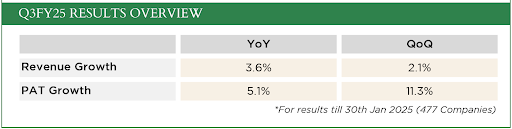

MSCI Rebalancing

India’s allocation in the MSCI Emerging Markets Index has fallen from 16.3% to 14.8%, as investors shift towards undervalued markets like China and Brazil. This decline has triggered FII outflows, adding pressure to the markets falling trend. Compounding the impact, Q3FY25 earnings have been weak, signaling an economic slowdown. Among 477 companies, revenue growth stood at just 3.6% YoY (2.1% QoQ), while PAT growth was 5.1% YoY (11.3% QoQ). These disappointing results have further dampened investor sentiment, leading to portfolio realignments ahead of the MSCI rebalancing. As both FIIs and DIIs adjust their positions, the midcap and smallcap falling trend is expected to persist. Investors should track earnings revisions and capital flows to assess market stability post-rebalancing.

The post has described the reasons for the fall in small and mid cap fantastically.

Amazing research..