Germany Breaks the Rules—And the DAX Breaks Out Over 25%

Germany was branded the “sick man of Europe” in the late ’90s as the burden of reunification dragged it into a deep recession.

Two decades later, the label returned—this time, with good reason.

Post-COVID, just as Germany seemed to regain its footing, Russia’s 2022 invasion of Ukraine triggered an energy shock, fueling recessionary pressures amid rising geopolitical tensions.

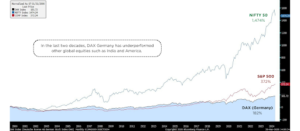

By 2024, the cracks were undeniable. Growth had stalled, investor confidence had faded, and the DAX had been stuck in place for nearly two decades. Once again, a pressing question emerged: had Germany lost its edge?

Then, in early 2025, everything changed.

In February, Germans elected a new government led by Friedrich Merz. Within weeks, the new leadership unveiled a sweeping infrastructure fund and a bold plan to reform the country’s constitutionally enshrined debt brake.

Result?

By March, the DAX had surged nearly 25% in six months, hitting record highs. But this rally isn’t just about economic data or shifting sentiment. It’s about a nation choosing political courage over caution—finally turning the page on two decades of stagnation. Let’s unpack how and why this happened.

A Market That Was Massively Undervalued

As of 31st October 2024, German equities were among the cheapest in the world.

| Key Metrics | DAX – German Index | S&P 500 – USA Index | NIFTY 50 – India Index |

| P/E Ratio | 17x | 29x | 24x |

| Market-Cap-to-GDP | 46% | 195% | 145% |

To put that in perspective: the German stock market was valued at less than half the size of its economy, while the U.S. market was nearly twice the size of its GDP.

This wasn’t due to weak fundamentals. German companies like Siemens, SAP, and Bayer were still generating strong global revenues. But sentiment was crushed by fiscal gridlock, a recession in 2023, and underwhelming government spending. In fact, Goldman Sachs noted that European stocks were trading at their biggest discount to U.S. equities in over 35 years.

That Catalyst Arrived in March 2025

Germany’s parliament passed a historic constitutional amendment:

- A €500 billion infrastructure fund, spread over the next decade

- Exemption of defense spending beyond 1% of GDP from fiscal limits

Germany’s commitment to fiscal discipline wasn’t born out of bureaucracy—it was forged in a century of economic trauma.

It all began with the hyperinflation of the 1920s, triggered by World War I reparations and unchecked money printing. Back then, bread cost billions of marks! Savings were wiped out. This collapse planted a deep-rooted cultural fear of inflation and borrowing.

The Great Depression in the 1930s only reinforced that fear. Unemployment soared, austerity deepened the pain, and social unrest exploded—setting the stage for the rise of extremism.

Post-World War II, the country lay in ruins. Industrial output had collapsed, housing was destroyed, and food production was half of pre-war levels. Out of that chaos came the German Economic Miracle, powered by reforms for free markets, price stability, and limited state intervention.

But stability came at a price. After reunification in 1990, Germany took on nearly €2 trillion in debt to integrate East Germany—pushing deficits beyond EU limits. Then came the 2008 global financial crisis, reigniting inflation fears. The political response? The “Schuldenbremse”, or debt brake, enshrined into the constitution in 2009. It capped the federal deficit at just 0.35% of GDP, and banned German states from new net borrowing. For over a decade, it was praised as Germany’s fiscal fortress—preserving credit ratings and making it the EU’s financial anchor.

But by the 2020s, that fortress had become a prison. Aging infrastructure, a post-COVID recovery, rising global tensions, and years of underinvestment demanded flexibility that the debt brake couldn’t provide. Germany had the resources—but couldn’t use them.

Then came the tipping point. As Russia’s aggression escalated and the U.S. signaled its retreat, the pressure on Germany became undeniable. In 2025, U.S. Vice President J.D. Vance declared NATO allies must “take primary responsibility for their own defense.” For decades since World War II, the U.S.A. and Europe thrived in a symbiotic marriage with strong ties in defence and economic growth.

But Trump’s historic withdrawal marked a painful divorce. Europe could no longer rely on U.S. protection and was forced to face the reality of self-defense. As one of the largest economies with significant manufacturing power, Germany had no choice but to build its own defense capabilities. Its long-standing fiscal restraint, once a point of pride, now became a hindrance.

Let’s Talk Infrastructure First

€500 billion isn’t pocket change—it’s a war chest. Germany’s roads, railways, hospitals, and digital networks have been creaking under decades of underinvestment. The amendment flips the script, channeling funds into transformative projects, where Germany would finally spend big on:

- Expanding high-speed rail networks and upgrading renewable energy grids to power its green transition

- Overhauling digital infrastructure, including 5G connectivity and AI-enabled public services

- Revamping its military with next-gen drones, cyber defense systems, and autonomous surveillance platforms

New projects mean jobs—lots of them—spanning construction workers, engineers, and tech specialists. Supply chains kick into gear, from steelmakers to software developers. The multiplier effect ripples through, boosting consumer spending and juicing GDP.

Defense: A Geopolitical Power Play

If infrastructure is Germany’s bet on growth, defense is its insurance policy. For decades, Germany’s military spending remained subdued—held back by post-war caution and the constitutional debt brake.

The March amendment exempts defense spending above 1% of GDP, unlocking tens of billions in fresh funding. Over the last 6 months, defense stocks like Rheinmetall (up over 160%) and Hensoldt (up over 140%) have rallied as investors anticipate a CapEx surge. Rheinmetall is expanding production of tanks and munitions, while Hensoldt is scaling up in radar and electronic warfare systems.

Political leaders have echoed the urgency. Macron has called for a “European defense renaissance,” and German Finance Minister Christian Lindner affirmed, “A secure Europe is now an economic necessity.”

This is more than a policy shift—it’s a long-term rearmament cycle. Germany is stepping up not just as an economic powerhouse, but as Europe’s defense anchor.

In Sum, This Rally Isn’t a Fluke—it’s a Signal.

Before the amendment, Germany’s stock market was a diamond in the rough—undervalued, underappreciated, and ripe for a breakout.

So why the 25% rally? Simple: markets eventually catch up to fundamentals and the concept of mean reversion is a universal truth. And when the narrative changes, they move fast. Germany’s €500 billion plan wasn’t just a spending package—it was a signal. A break from rigidity, a bet on growth, and a reassertion of ambition. Infrastructure spending fuels productivity; defense spending reinforces sovereignty.

Yes, the ECB’s dovish stance and global recovery helped. But this amendment was the spark that flipped the switch.

We’re now seeing the early signs of a global capital rotation—from stretched U.S. valuations to European equities that still trade at a discount. For long-term investors, this is more than a rally—it’s the start of a structural re-rating that will play out over the next decade.