Author : Aequitas

Monthly Update – February 2023

January 2023 – This month is very special for us from an Aequitas perspective – We have just turned 10 years old. This journey has been an incredible one where we have positioned ourselves against the grain (both in terms of Business Model as well as in terms of investment strategy) gone through multiple macro and microeconomic events and yet managed to come through with flying colours.

While a performance of 29% CAGR over 10 years could let complacency creep in, in a lot of firms, the fire inside Team Aequitas still burns as strong as ever.

We take the opportunity to thank all our investors who have reposed their unwavering faith in us and pledge to keep on doing what is right from “Our investors” perspective to the best of our ability.

At our end, we have pushed the reset button with the objective to try and better ourselves over the next decade.

Fund Update – While the markets were very choppy with the broader indices showing a sea of Red in the last week of Jan, our strategy stood out despite the challenging times and our focus on “results and not narrative” helped our investors tide over Jan. We keep on having our focus on our three pillars while identifying new Businesses to invest in i.e., Value, Growth and Contrarian.

We keep on being wary of the 3 risks – Valuation Risk, Balance Sheet, Earnings Risk.

The month had all the ingredients that prove the adage, “Sometimes nothing happens in Decades and sometimes decades happen in weeks”.

We had so much action starting from –

• Bad news making headlines – Market participants getting shaken both in the Private Equity space (Go Mechanic) and the public Market Space (Hindenburg report on Adani and its impact that the markets are still seeing unfurl). The good news is that these aren’t the first, and the bad news is that these aren’t going to be the last ones. However, since these events are rare and not ones that have a lasting impact, investors should look upon these events as opportunities to invest as these events tend to take the froth out of the market in general – but investments should be prudent and focused on companies with clear growth visibility.

Despite the choppiness our portfolios both on AIF and PMS closed marginally up, but more importantly did not exhibit any of the choppiness seen in the broader markets.

• Indian Budget – The last full budget which was presented by FM Sitharaman – the part that stood out in the headlines was the consistency – whether focusing on Infra spends, leveraging on the Digital India stack, increasing sectors availing PLI benefits and increasing ease of doing business; at the same time trying to make the New Tax regime more relevant from a New assesses perspective. It did take away some of the Tax anomalies by Taxing MLD’s and REITs/InvITs.

• International News – On expected lines that the Fed hiked the rates by 25 bps – with a lot of economic data signaling a slowdown, except the unemployment data which keeps on surprising everyone by coming out with yet another strong employment data– we keep on looking at it from the sidelines. The Bank of England, too, has reduced the pace to 50 bps hike.

We believe tackling runaway inflation without tipping the economy into recession is one of the biggest challenges that Central Banks across the Developed world have. Unfortunately, we have lived with an easy Monetary policy for a very long time, and the impact of these hikes is something that we will see only as time goes by. We believe that the tools that the Central Banks have are limited. We believe that not only Monetary & Fiscal will but also Political will go a long way in trying to get inflation sustainably under control.

• Chat GPT – There was so much noise about the AI that we had no option but to really give it a go – and must admit it was quite impressive.

Budget FY’24 – By the time this reaches out to you enough and more notes would have reached out to you, therefore focusing only on the impact that the Budget has on our portfolio –

• The infrastructure outlay is Rs 10 Lac Crores – It is up by 33%; we are overweight on infra. With this, the total investment in infrastructure will be 4.7% of GDP – which is bound to change India as we know it; It is positive.

• Railways investment allocation has gone up by 9 times in 9 years – which is being now reflected in the much higher quality of trains (both in terms of speed and comfort) that we have – Positive from our portfolio perspective.

Our portfolios are heavily focused on these 2 sectors (Infra and Capex) along with B2B Manufacturing, Media, Auto – we believe that above should help create more visibility of business in our portfolio.

Bubble trouble – The story of start-ups

What we are here to talk about is the challenges of investing in start-ups. And the challenges are not just limited to cherry picking the right businesses that’s actually addressing a need of the market and is expected to do well but goes well beyond into the character of the Founders.

Finding a scalable and relevant to the future business by itself is a huge ask and most investors till around 1 year ago found it difficult to identify and resorted to “Spray and Pray” method, i.e., give some allocations to all and hope that one of them ends up becoming a 100X and covers up for the losses in others and maybe have a few others which do something OK so that the overall startup portfolio hopefully delivers an IRR in the range of 25-30%.

The bigger challenge is when the Startup founder moves away from his core – “Solution for bringing about a radical change in the world” to succumbing to external pressure and start compromising his ethics to finding the “Solution to stay afloat till his idea can be sustainable to radically change the world”.

In simpler words, “Fake it till you make it”. This is a phrase used by Startup founders who kept on setting aggressive delivery expectations so that they could get their next round of investment, but they ensured that they kept on working towards making their venture a success. The likes of Larry Elison of Oracle, Bill Gates, Jeff Bezos, and Elon Musk are examples of aggressive businessmen who have executed the above and have been applauded as risk-takers who gave it their all to succeed.

Then there are those start-ups who turned aggressive on their accounting books and focused more on “Cooking” the books to stay solvent. The time and energy taken in the latter were so high that the focus eventually was just “Bookkeeping management” and not “Business management”.

Today we will bring up a few cases where start-up founders have abused the system and got caught on the wrong side. But most important highlighting that some very large institutions as well as Hedge funds have been caught investing the in the aura of the founders and found themselves to have gaping holes in their Balance sheets.

Valeant Pharma

Michael Pearson a former Mckinsey consultant was the C.E.O. of the drugmaker Valeant. Valeant Pharma’s stock price rose more than four thousand percent during his tenure. The influential hedge-fund manager Bill Ackman, one of Valeant’s largest shareholders, compared Pearson to Warren Buffett, citing his genius at capital allocation.

Valeant used to be a small drugmaker, struggling to stay afloat. Pearson, who took over in 2008 argued that returns on R&D were too low and too uncertain; it made more sense to buy companies that already had products on the market, then slash costs and raise prices. So, Valeant became a serial acquirer, doing more than a hundred transactions between 2008 and 2015. It invested almost nothing in its core business.

In 2015 of the nineteen drugs whose prices had risen between three hundred percent and twelve hundred percent in the previous two years; half belonged to Valeant. The company also pulled every trick in the financial-engineering handbook. In 2010, it merged with a Canadian company, to bring down its tax rate, and it sheltered its intellectual

property in tax havens like Luxembourg. It used opaque accounting methods that made it hard for investors to judge how well-acquired companies were doing.

Eventually they got caught and Valeant’s stock price has now fallen almost ninety percent, thanks to a toxic combination of sketchy accounting, political blowback, and slowing growth.

JP Morgan investment in Frank – Frankly it was a fraud

JP Morgan Chase is suing the 30-year-old founder of Frank, a fintech startup it acquired for $175 million, for allegedly lying about its scale and success by creating an enormous list of fake users to entice the financial giant to buy it.

Frank, founded by former CEO Charlie Javice in 2016, offers software aimed at improving the student loan application process for young Americans seeking financial aid. Her lofty goal was to build the startup into “an Amazon for higher education” and had investors like billionaire Marc Rowan, prominent venture backers including Aleph, Chegg, Reach Capital, Gingerbread Capital, and SWAT Equity Partners.

The lawsuit claims that Javice pitched JP Morgan in 2021 on the “lie” that more than 4 million users had signed up to use Frank’s tools to apply for federal aid. When JP Morgan asked for proof during due diligence, Javice allegedly created an enormous roster of “fake customers” – which had all personal information for 4.25 million ‘students’ who did not actually exist. In reality, according to the suit, Frank had fewer than 300,000 customer accounts at that time.

Twitter Fake Account

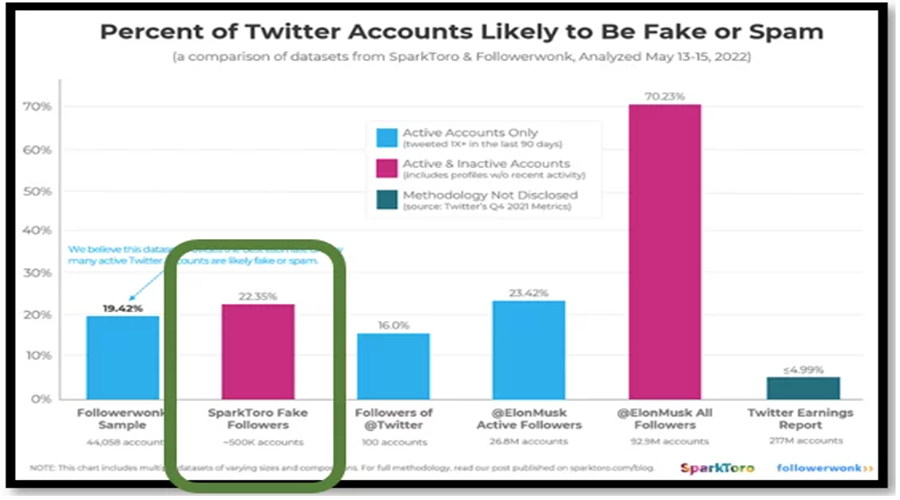

When Elon Musk was making a bid for Twitter the only thing that held him back was data from Twitter – while Twitter claimed that approx. 5.4% of their accounts were fake, Musk put out a much higher number. While Musk since then has taken over the firm at the same price of $44 billion, his question has put out a lot of independent companies to find the number of fake accounts on Twitter. According to SparkToro, it is approx. 19.5%.

Indian Start-ups which have got caught on the wrong side

Closer to home too we have had a few instances where start-up founders have been accused of being very aggressive in their accounting. Since describing their businesses and the issues would take up a lot of your precious time, we just would like to highlight the investors.

Aequitas’ Learnings and observations– All the above investment companies had professionals who are amongst the best Investment, legal professionals, and experienced Mentors and yet they floundered. We have of late seen a lot of investors investing into investment firms venturing into this space with no regard for valuations and only focusing on the narrative, this we believe is a sign of froth and should be evaluated very carefully by investors before taking the investment call.

ChatGPT – We have had a lot of fun with ChatGPT in the month gone by – we believe that this is a Technology that will make us all sharper and make for crisper engagements.

Sharing with you an example of the fun that we had with ChatGPT. Prompt to ChatGPT – Act like a poet and make sonnets of portfolio managers who say that they are value investors and follow buffet but do the opposite and buy momentum stocks. include that they chase AUMs and benchmark their portfolio to benchmark all the while saying that they chase absolute growth stocks. Also, add that they claim to be long term investors but churn their portfolios every 12/15 months.

“Oh, the irony of those who claim to be in value plays

But chase momentum stocks instead, it’s quite a shame

They boast of following Buffett’s lead

But in reality, their actions do mislead

They chase absolute growth with a fervent desire

But is AUM growth what they truly admire

They churn their portfolios every year or so

But in meetings, a long-term hold is what they show

They benchmark their returns to the market’s pace

But Alas! true success comes from a different space

They claim to be wise and disciplined investors

But their actions reveal their true colors as pretenders.”

Hope you all enjoy reading this edition as much as we enjoyed creating it