Author : Siddhartha Bhaiya & Subham Agrawal

The asset classes we think will do well in the future

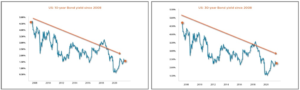

The last decade has probably been one of the worst periods for bond holders ever since the first-time interest was charged for lending money on paper currency. Bond yield on US 10-year G-sec has averaged a paltry ~2.5% over the last decade. Yields have in fact trended downwards from ~4.5% in 2008 to the 1.6% currently.

Why are yields so low?

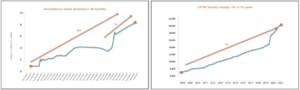

Since the global financial crisis of 2008, central banks across the world have resorted to relentless money printing. In the last 18 months, the United States alone has seen more than 37% increase in money supply as the FED printed close to $ 4 tn to combat the impact of Covid-19.

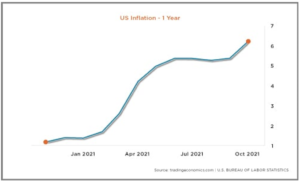

This increase in money supply should ideally have led to higher inflation. However, headline Inflation remain muted throughout the last decade as a substantial part of the increase in money supply flowed into various asset classes (Read here about the impact on money printing and what the FED is planning to do next)

Analysing the relative Impact on Bondholders?

We all know that the last decade has probably been one of the worst periods for owning bonds, but here we go about exploring the scenario as to how bad it actually was.

The US money supply (m2) in 2008 was ~$ 7.5 tn and $ 75 bn invested in bonds represented 1% of US money supply.

That $ 75 bn invested in bonds would have been worth ~$ 104 bn in 2021 (for the sake of simplicity we have used the compounded average 10-year bond returns at an average yield of 2.5%) However, the US money supply now stands at ~$ 21 tn and therefore the relative value of $ 75 bn bonds has declined from 1% of US money supply to ~0.5% of the US money supply. All things being equal the bond holders are now 50% poorer as compared to 2008. But there is a bigger catch, a lot of the increase in global money over the last decade has gone into asset prices like equities, real estate, start-up, cryptocurrencies etc.

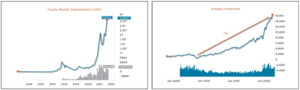

The value of those assets has gone up anywhere from 300% to 1000% and virtually infinite in case of Crypto’s and start-ups. Total valuation of Crypto’s have gone up to astronomical levels of ~$ 3 tn from virtually zero in 2009 and 2021 is witnessing 1.4 new unicorns getting created every day. This compares to just 1 start-up reaching the unicorn status between 2007-09 (440 unicorns in 2021 vs 903 since 2007). (Source: cbinsights)

So, it would be fair to say that the relative value of the bond holders is now not 0.5% but probably a

fraction of 0.5%.

To state that bond holders have received the rough end of the stick is a massive understatement.

What do we think happens going forward?

The bond yield on US 10-year G-sec is currently a paltry 1.6%. When compared with growth across sectors, the relative value for bonds has declined more than 50% over the last decade. Cheap money has fueled a boom in some asset classes while other asset classes have seen a massive relative dip in their values.

Let’s discuss the relative performance of various asset classes over the last decade and what asset classes we think will do well in the future.

We think WPI and CPI are going to increase, and we are already seeing signs of it as the US reported 6.2% inflation for the month of October (the highest inflation reading in last 30 years and 3x US central bank target of 2%). This should put upward pressure on interest rates (hopefully next decade would be a lot better for bonds).

Valuations of Crypto’s and start-ups which have been fueled by cheap money could correct massively once interest rates rise. Signs in this segment have the reminiscence of all past bubbles from tulip mania to the dot com boom.

Consumption companies which benefited due to low commodity prices over the last decade should start seeing impact on their margins and valuations. Be wary of companies with high PE!

Where to allocate capital?

Companies which benefit from increases in WPI and CPI are likely to do well. (Hard and soft commodities, manufacturing and infrastructure (read here about why we think commodities and old economy will do well)

Invest in a low duration Bond portfolio as rise in Bond yield will have a negative impact on Bond price.

Gold should act as a hedge against inflation and should do well as money pours back into gold. We are super bullish on gold!

To understand more about this topic or for more interesting discussions, drop us an email at info@aequitasindia.in

Sources:

https://www.statista.com/statistics/1121448/fed-balance-sheet-timeline/

https://www.macrotrends.net/2016/10-year-treasury-bond-rate-yield-chart

https://in.tradingview.com/chart/?symbol=CRYPTOCAP%3ATOTAL

https://www.cbinsights.com/research-unicorn-companies

https://in.investing.com/indices/nasdaq-composite

https://tradingeconomics.com/united-states/money-supply-m1

https://fred.stlouisfed.org/