Author : Nishith Shah & Siddhartha Bhaiya

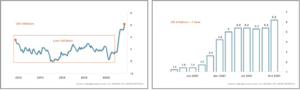

Since the global financial crisis of 2008, central banks across the world have resorted to relentless money printing. In the last decade, the United States alone has seen a 10x jump in money supply (M1). The FED increased the pace of money printing in response to the COVID – 19 pandemic.

Now with the global economy recovering and inflation rearing its head again, talks of FED tapering and interest rate hikes have again started doing the rounds.

It’s important to understand the FED’s decision to taper and align our financial decisions with it. Always adhere to the old wall street adage ‘Don’t fight the FED’

We believe it’s going to be extremely difficult for the FED to meaningfully taper their Balance Sheet without bringing about a major collapse in global asset prices.

So let us simplify this for you and understand if this will impact your income / wealth and how we deal with this.

What do we mean by tapering?

The pace of bond purchases by FED going down. Absolute money supply isn’t likely to shrink, and it has never shrunk after we left the gold standard behind. (Chart 3)

(The US money supply (M1) has increased by 300% since COVID, effectively 75% of the currency in circulation currently did not exist 18 months ago.)

So, where is the Inflation?

Technically speaking, with such massive money printing, we should have had massive inflation but ironically over the last decade most of the developed countries have been grappling with deflationary pressures, until a year back.

Over the last decade, The US and all major countries have been able to run massive fiscal deficits because headline inflation, as is measured by the central banks (i.e., WPI/CPI) has been extremely low.

Now, where did all this money go?

Majority of the money printed went into capital assets like stocks, real estate, art, start-ups, crypto’s etc., which does not get captured in your WPI / CPI inflation.

It all went into the asset classes rather than into factors of production like materials and labor.

How long is the party?

As headline inflation remained low, there was no pressure on central banks to raise interest rates.

Low inflation + Low interest rates + massive increase in money supply were a heady cocktail for asset prices to go through the roof and the party was on for all asset owners.

With interest rates near zero for most part of the decade and global markets gushing with liquidity, WACC of capital slowly kept on going down and valuations started hitting the stratosphere.

Will inflation be the party pooper?

Central banks conveniently ignored the asset inflation and focused on a much narrower form of inflation (i.e., WPI / CPI)

With inflation, as measured by central banks rearing its head back, the central banks are under pressure, not only to increase interest rates but also to suck out excess global liquidity.

Central banks will focus on reining in inflation by increasing interest rates and trying to suck out excess global liquidity. However, the major beneficiaries of loose monetary and fiscal policy have been asset prices and as the FED unwinds its stimulus, the deflation will be profound on asset prices rather than on WPI / CPI.

Can the FED let asset prices go down dramatically? And whether it will impact your Income or Wealth?

While WPI and CPI levels impact income levels (which is annual), asset prices impact wealth (which could represent lifetime of savings).

With the majority of the global money supply now locked up in asset prices, our view is that central banks cannot meaningfully taper without a significant collapse in asset prices (which can obviously affect votes and elections).

So, our view:

● FED will have no option but to increase interest rates

● There will be no major decline in money supply

● Rate increase = WACC increase = valuations declining

● Asset prices will go down gradually but will not collapse

● WPI / CPI is unlikely to go down immediately

So, what to do?

Your best bet is to hedge yourself by buying commodity and old economy stocks, as they have been starved of capital for nearly a decade. In their case the valuations are cheap, and the earnings could go through the roof!

To understand more about this topic or for more interesting discussions, drop us an email on info@aequitasindia.in

Sources:

https://tradingeconomics.com/

https://in.tradingview.com/markets/cryptocurrencies

https://data.worldbank.org/indicator/CM.MKT.LCAP.CD

https://www.macrotrends.net/2577/sp-500-pe-ratio-price-to-earnings-chart

https://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm

https://tradingeconomics.com/united-states/money-supply-m1

https://tradingeconomics.com/united-states/money-supply-m2

https://tradingeconomics.com/united-states/inflation-cpi

https://tradingeconomics.com/united-states/interest-rate

https://www.macrotrends.net/2577/sp-500-pe-ratio-price-to-earnings-chart