We focus on facts and fundamentals and ignore market narratives.

SPEARHEADING

SMALL & MID CAPS

Decoding Multibaggers, Indian equity market

SPEARHEADING

SMALL & MID CAPS

Decoding Multibaggers, Indian equity market

About Aequitas

Offshore Fund

Aequitas India Fund OEIC Ltd. is a DIFC registered, dollar denominated fund for international investors investing in Indian markets. This Offshore Fund is registered with the Dubai Financial Services Authority (DFSA) as an Exempt Fund to manage collective investment funds with the Fund Manager as Aequitas Investments (DIFC) Limited being duly regulated by DFSA.

Aequitas – Brand Story

Launched on 21st March’ 22, Aequitas Investments (DIFC) Ltd. is a wholly owned subsidiary of Aequitas Investment Consultancy Pvt. Ltd. (AICPL), a Mumbai-based boutique investment firm that specializes in generating outsized returns through investing in small and mid-caps in Indian Equity market.

Aequitas group was founded in 2012 to break-free from the conventional ways of wealth generation for Investors. Siddhartha Bhaiya, MD & CIO of Aequitas Investment Consultancy, had 10 years+ experience in the AMC Industry prior to starting Aequitas. During this time, he noticed that every AMC around is in the race of building AUM and to achieve this disillusioned key performance indicator, they were taking the distributor route. Having a contrarian mindset, Siddhartha believed in single-mindedly focusing on generating returns for our Investors, and AUM will gradually build as a byproduct – and he surely was right.

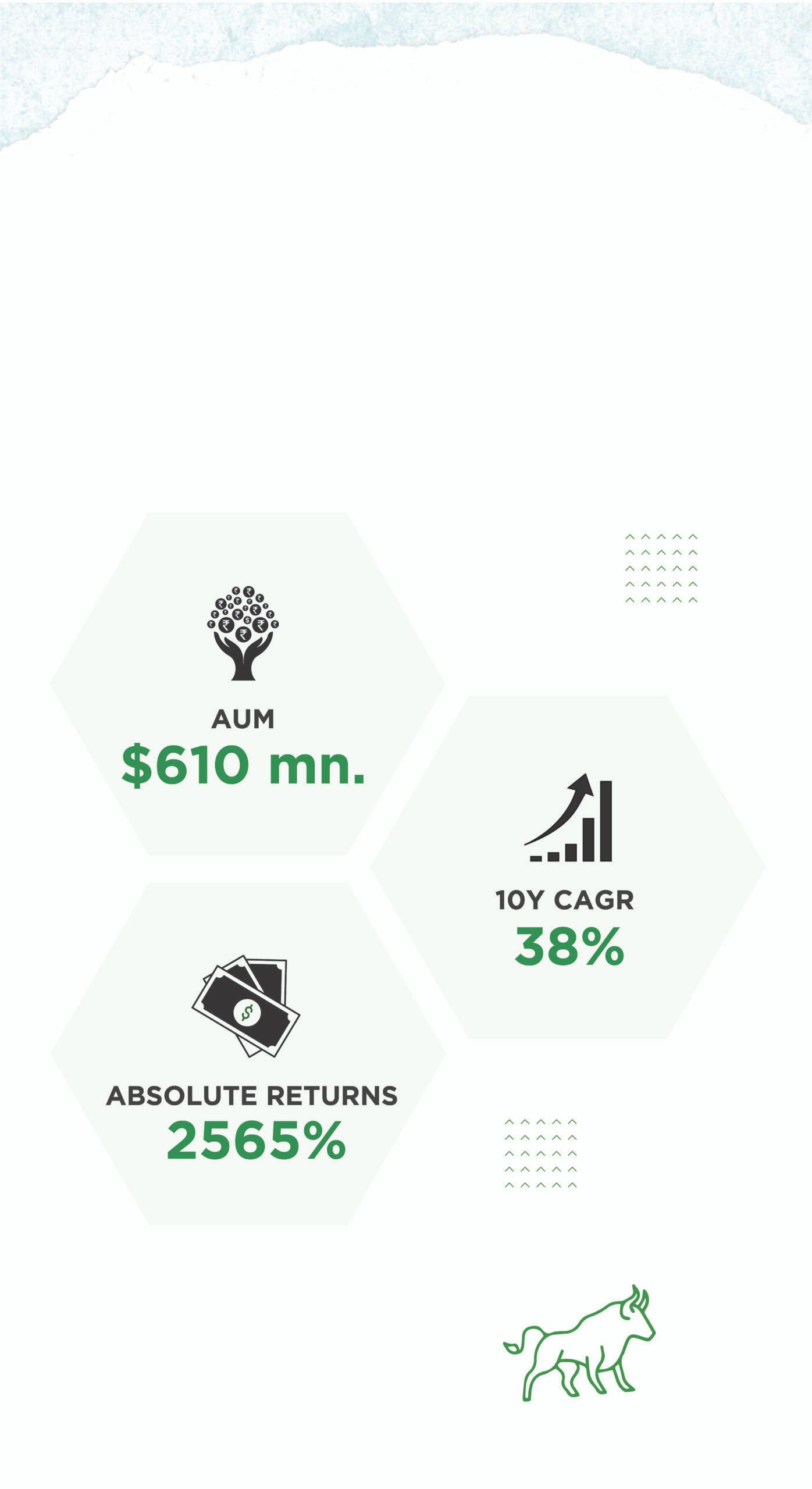

The journey began with an AUM of $1.8 million in 2013, and 11 years later in 2023, Aequitas group’s AUM stands tall at $610 million and growing, built organically without any distributorship and empanelment.

Our Approach

Investment Philosopy

Our investment philosophy is simple, we walk the talk. We believe that savings doesn’t create wealth for you, investing in the right manner does and through a carefully planned strategy, we deliver what we promise.

Focus & Discipline

-

-

We do not chase momentum or hot stocks.

-

We do not indulge in derivatives or IPOs.

Multibagger Approach

-

Growth: The company must have above average growth potential for the next 3-5 years.

-

Contrarian: We do things differently, which is a must to identify Multibaggers.

-

Value: The valuation must be reasonable with a definite potential of re-rating soon.

Qualitative Analysis

-

Screeners: To analyze fundamental financial metrics

-

Research: We do our own primary research.

-

Portfolio Construction: Identify 20 robust stocks, fit across all above parameters.

-

Ongoing research: Revisit the research timely to take informed decisions.

Portfolio Construction

-

We aim to construct a portfolio of around 20 quality stocks that are fundamentally strong, with a focus on mid and small cap growth companies, with a horizon of 3-5 years in mind.

Why Small caps

-

Have outperformed large caps through upcycles.

-

Many large companies started as mid/ small caps.

-

‘Riskier than large caps’ is a myth.

Selection Criterion

-

Industry Leaders

-

Low Debt

-

Good Management

-

Valuations

-

Creeping Acquisition/ Buy Backs

-

Cash Flow

Risks

-

Risk equates to what Ben Graham called a “permanent loss of capital”.

-

There are 3 risks that we particularly focus on:

- Valuation Risk

- Earnings Risk

- Balance Sheet Risk

Benefits of investing in offshore fund under DIFC

-

Tax saving: Non-resident investors in the fund selling / redeeming their interest in the Fund and the consideration is received outside India, the gains arising from such sale/redemption should not be subject to tax in India. Further, through Aequitas’s offshore fund, investors enjoy the advantage of not having to pay 18% GST on the fee.

-

Jurisdiction: DIFC is a free zone that is a neutral jurisdiction. A neutral jurisdiction refers to a geographic area or country that is not aligned with any group or alliance and is neutral in conflicts or disputes between other parties. This neutral position makes offshore funds a safe way to invest in Indian markets and reduces transaction costs.

-

Ease of Process: India is one of the fastest growing markets in the world. But for investors based outside the country, the process of investing in India can become quite cumbersome and tedious. With Aequitas’s offshore funds international investors can invest without the hassle of converting their funds to INR.

-

Structural advantage: Since this is a fund structure, existing investors always benefit from fresh money flowing into the existing pool. This gives the offshore fund manager the freedom to invest in new ideas as per the correct market conditions. For the investors, even without topping up or putting in fresh money of their own, they can enjoy the advantages of fresh ideas being undertaken by the fund manager.

Growth Opportunities in India

We at Aequitas have addressed this query for global investors multiple times.

However, this time we thought to let Institutional Investors like Julius Baer, Goldman Sachs, Deutsche Bank and Bloomberg answer on our behalf.

We at Aequitas, with 10yr+ experience & best in class research & returns will be happy to answer any of your queries.

Our Founder

Siddhartha Bhaiya

Siddhartha Bhaiya is the Managing Director and Chief Investment Officer at Aequitas.

He is a qualified CA and the driving force behind Aequitas with more than 20 years of experience into Equity Research

and Equity Fund Management. He has been instrumental in taking Aequitas from a start-up to one of

the consistently best performance track-record in the industry. He believes in generating outsized

returns by investing in small cap undiscovered companies. With exposure across all market capitalization

companies, he is a specialist in bottom-up stock selection – the Multibagger approach.

TESTIMONIALS

What our Investors are talking about

Jai Kishan Awtani

Partner, White Rose Trading Investor Since 2022

Been invested with Aequitas for a year and a half and Sid’s performance has been nothing short of phenomenal. What sold us was his passion for stocks and his investment philosophy. Master of value investing!! Keep up the great performance team Aequitas!

Soly Mathew

Deputy GM, Gulf Bank Investor Since 2022

The portfolio is managed by professionals under the leadership of Siddhartha and the performance has been superb, beating the market index each month since I invested! Absolutely satisfied with their service throughout my investment period.

FAQs

? Who can all invest?

The fund is an ideal vehicle for foreign investors (NRIs, FPIs, FIIs, etc.) to invest in the Indian markets.

? What asset class does the fund operate in?

Indian public listed companies.

? What is the structure of the fund?

A private open-ended investment company incorporated in the Dubai International Financial Centre and registered as an Exempt Fund and a Hedge Fund with the DFSA. The Fund has a CAT 1 FPI License to invest in the Indian Markets.

? What is the Minimum Investment size?

$1 Million

? What is the tax treatment in Aequitas Offshore fund – Aequitas India Fund OEIC Ltd?

“DIFC and UAE Tax Considerations: As a company established in DIFC, the fund is subject to zero tax rate of corporate income tax for 50 years commencing from 13 Sep 2004. Value added tax (VAT) is applicable at a standard rate of 5% on the fees. Indian Tax Implications: Since, the fund primarily invests in Indian listed equities, it will be subject to capital gains arising from buying and selling of listed shares. Capital gains in India on listed equities are of 2 types: Short term (15%) and long term (10%). Dividend income received by the fund from Indian companies would be subject to 20% favorable tax due to the India UAE Tax treaty. Since investors as well as the fund are international and not based in India, investors will not be subjected to taxes in India.”

OUR EXPERTS

Investment Philosopy

Our investment philosophy is simple, we walk the talk. We believe that savings doesn’t create wealth for

you, investing in the right manner does and through a carefully planned strategy, we deliver what we

promise.

Business

Why Small caps

Insurance

Selection Criterion

Business

Risks

Policies

Qualitative Analysis

Business

Portfolio Construction

Business

Multibagger Approach

Insurance

Focus & Professional Discipline

USPs

Timeline for our Milestones

Aequitas was founded by Siddhartha Bhaiya & Neerav Shah. Started with PMS, and AUM of INR 10 Cr. (can we also have a picture from 2013) AUM: INR 10 Cr.

2013

2016

Moved to the new office in the financial center of Mumbai, BKC. (can also have a picture) AUM: 300 Cr., CAGR: 16%

We launched our AIF, Aequitas Equity Scheme 1, for investors who want to start their journey with lower ticket size. AUM: 1500 Cr., CAGR: 24%

2019

2021

Business Development Team was established to drive customer relationship with stakeholders. AUM: 2500 Cr., CAGR: 28%

We started our new offshore fund based out of Dubai International Finance Centre (DIFC), to attract global investors. AUM: 3000 Cr., CAGR: 31%

Onboarded our 1st Institutional client.

2022

2023

Partnered with Kotak Alternate Assets Manager Ltd. as an independent advisor for investors.

Moved to our new office in BKC. The Capital building. AUM: 3500 Cr., CAGR: 37%

OUR EXPERTS

Meet our experienced

team people

Our Products

We are confident there is one for you!

Portfolio Management Services

Aequitas India Opportunity Product (our PMS) is an ingenious solution that is one of the leadingPMS in India with a consistent record over a period of 10+ years. The minimum ticket size for PMS is INR 10 Cr.

Alternative Investment Funds

The minimum ticket size is INR 3 Cr. Aequitas Equity Scheme 1 (our AIF) is a category 3 long only AIF with fortnightly subscription of mid-month and end of month.

Offshore Fund Under DIFC

The minimum ticket size for our offshore fund is $1 million. The fund is an ideal vehicle for foreign investors (NRIs, FPIs, FIIs, etc.) to invest in the Indian markets.

TESTIMONIALS

What our customers are

talking about

Pellentesque habitant morbi tristique senectus netus et malesuada fames ac turp egestas. Aliquam viverra arcu. Donec aliquet blandit enim feugiat mattis.

Kunal Babani

Partner - Satguru Builders

‘Aequitas is very process-driven and true to its investment thesis and Siddhartha’s conviction and foresight to understand cycles are unparalleled. I saw this during the Covid panic, when I called to ask him about our NAV. He gave me a date 1 year down the line, and told me ours would be the best performing fund by then. Surprisingly, that’s exactly what happened.

Anirudh Malpani

Obstetrician - Gynecologist Mumbai

I am a long-term value investor and have been with Aequitas since their inception. My returns have been spectacular. Through these 8 years, I have enjoyed my relationship with Siddhartha as he is extremely enthusiastic and passionate about stocks. I absolutely trust him to invest my money the right way.

B L Chandak

Executive Director-RP Sanjiv Goenka Group

I have known and interacted with Siddhartha for nearly a decade, and I can definitely say that he is one of the best in identifying multi baggers both in small cap and mid cap space before anyone else in the markets and I feel he does that by investing in high quality companies and industry leaders.

Arpita Bhattad

Senior Product Manager, Amazon

Being a professional in a highly demanding job with a hectic lifestyle, I understand the value of allowing investment managers to manage my money. I have regularly invested with Aequitas and with my investments multiplying, I can finally start planning for my dream home.

Latest news & articles from the blog

Safe your money

Lorem ipsum dolor amet consectetur adipiscing elit do eiusmod tempor incid idunt ut labore.

Get free quote

Lorem ipsum dolor amet consectetur adipiscing elit do eiusmod tempor incid idunt ut labore.

Fast & reliable

Lorem ipsum dolor amet consectetur adipiscing elit do eiusmod tempor incid idunt ut labore.

We are a leading investment firm with offices located in Mumbai, India & Dubai who specialize in global listed equity markets. Our clients comprise over a hundred UHNIs, family offices and global investors. With a net AUM of INR 52 bn., our 10-year CAGR of 27% (for PMS) has significantly outperformed the Nifty all along.

Contact

A-1003, The Capital Building, Behind ICICI Bank, BKC, Bandra -East, Mumbai -400051

-

info@aequitasindia.in

-

+91 72080 42953

-

Stay Updated. Stay Ahead