Author: Drish Israni

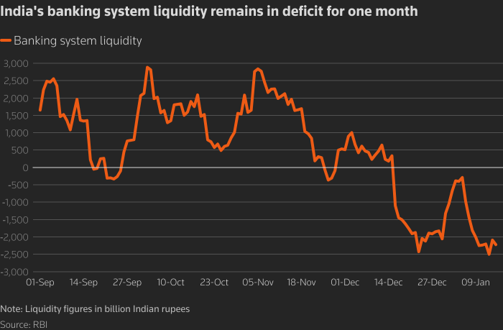

Why Indian Stock Market is Falling? Understanding the Impact of the ₹2.5 Lakh Crore Domestic Liquidity Deficit

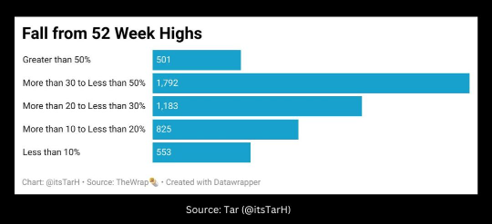

Indian stock markets have seen heightened volatility in recent weeks, with benchmark indices such as the Nifty 50 and Sensex experiencing sharp declines as of January 16, 2025. Overvaluation concerns, coupled with systemic challenges like a ₹2.5 lakh crore liquidity deficit in the banking system, have amplified market risks, leading to the Indian stock market fall. This shortfall in liquidity has put pressure on businesses, financial markets, and the broader economy, leading to a downward trajectory in stock performance.

Data as of 10 Jan, 2025

This article aims to provide insights into the Indian stock market fall and explain why markets are falling in the current environment.

Major Factors Behind Why Indian Stock Market is Falling: ₹2.5 Lakh Crore Liquidity Deficit

The liquidity deficit reflects a shortfall in the banking system’s ability to meet immediate funding needs. This arises when banks collectively borrow heavily to maintain operations and comply with statutory liquidity requirements.

Key Drivers of the Liquidity Deficit

Government Capex Slowdown: Government capital expenditure has slowed significantly as India’s fiscal deficit reached 52% of the FY25 target by November 2024, according to CGA data.

Advance Tax and GST Outflows: Large-scale fund withdrawals due to periodic tax payments and monthly GST liabilities.

Sluggish Deposit Growth: Credit growth of 15% year-on-year has outpaced deposit growth.

RBI’s Forex Market Interventions: To stabilize the rupee, the RBI has sold dollars in exchange for rupees.

Data until 10th January 2025

Impact of Domestic Liquidity on Indian Stock Markets

1. Rising Borrowing Costs

As liquidity tightens, short-term interest rates in the interbank market have surged above the repo rate. This increases borrowing costs for businesses, compressing profit margins and weighing on stock valuations.

2. Limited Monetary Policy Transmission

Tight liquidity hampers the RBI’s ability to stimulate economic growth through rate cuts. Despite recent reductions in the policy rate, banks have been reluctant to pass on the benefits to borrowers, reducing credit availability and further slowing corporate earnings growth. This limitation further explains the ongoing stock market fall.

Additional Factors Impacting Indian Stock Market Fall

1. Record Insider Dilution

Promoter and insider selling have reached record levels in recent months, with key personnel offloading shares in their companies. This trend often signals that insiders perceive stocks to be overvalued. As of September 2024, promoters of nearly 180 companies sold over ₹40,000 crore worth of shares through open market transactions.

2. Urban Consumption Slowdown

Recent data from the National Statistical Office (NSO) reveal a 10% drop in urban discretionary spending in Q2 FY25 compared to the previous quarter. As companies revise their revenue guidance downward, stock prices in these sectors are likely to come under additional pressure, exacerbating the Indian stock market fall

3. Public CapEx Slowdown and Poor Infra Execution

Capex grew just 7.4% year-on-year compared to 60% in FY24. This slowdown not only impacts GDP growth but also weighs on sectors like construction, engineering, and capital goods, leading to subdued stock performance in these industries.

4. Intervention in the Currency Market

In December 2024, trading volume in dollar-rupee non-deliverable forwards (NDF) at India’s offshore finance hub hit a record $161 billion, a 140% increase year-on-year. Such volatility can dampen investor sentiment, increasing uncertainty in the Indian stock market and adding pressure to valuations, especially for import-heavy and export-reliant sectors.

5. Foreign Portfolio Investor (FPI) Outflows

In the past 2 weeks of 2025, FPIs have pulled out over ₹38,000 crore from Indian equities, driven by concerns over rupee depreciation and rising U.S. yields. Currency volatility and tight domestic liquidity exacerbate these outflows, further resulting in the stock market fall.

Details on other Signs of Slowdown in Indian Economy, in our Newsletter

What Should Investors Do Amidst the Indian Stock Market Fall?

Partner with Professional Money Managers

- Leverage their disciplined and research-driven approach to portfolio management.

- Benefit from their ability to identify opportunities and mitigate risks using market insights.

Focus on Research-Driven Investment Decisions

- Analyze company fundamentals and macroeconomic trends.

- Prioritize stability and growth during volatile market conditions.

Adopt a Disciplined, Value-Driven Investment Philosophy

- Look for multibagger opportunities for long-term success.

- Learn from Aequitas Investments, which achieved a 10-year CAGR of 38% in PMS (as of February 2024).

Seek Expert Guidance

- Contact Aequitas Investments to understand the evolving market conditions.

- Gain clarity and support for achieving your financial objectives amidst the market fall.

Conclusion: Navigating the Challenges of a Falling Market

The current Indian stock market fall is driven by a combination of systemic factors, including a ₹2.5 lakh crore liquidity deficit, rising borrowing costs, insider selling, and foreign portfolio outflows. Economic challenges such as sluggish urban consumption, slowed government capex, and currency market volatility have further compounded market pressures. Amidst this turbulence, investors must adopt a disciplined, research-driven approach to navigate risks and uncover opportunities. Partnering with professional money managers, like Aequitas Investments, can ensure resilience and long-term growth, leveraging expertise to mitigate uncertainties and prioritize financial stability in these volatile times.