The China stock market has emerged as a global powerhouse, offering immense growth potential. For Indian investors, diversifying their portfolio by investing in China stocks can unlock new opportunities. This guide provides a comprehensive roadmap to help you understand how to invest in the China stock market from India, including the benefits, the process, and the associated risks.

Why Invest in China Stocks?

China boasts one of the largest economies in the world, driven by rapid industrialization, technological advancements, and a burgeoning middle class. Here’s why investing in China stocks makes sense:

-

Lucrative Valuations :

Prolonged underperformance combined with depressed headline valuations means Far East markets, especially Hang Seng listed equities provide a favorable risk-reward scenario

-

Ahead of the Bull run :

In the Q3CY23, inward FDI flows became negative for the first time since the start of the published timeline in 1998 and have turned positive since, showcasing renewed Investor sentiment.

-

Domestic Consumption :

China’s shift from an export-led growth provides massive opportunities for domestic consumption. Despite several economic upheavals, retail consumption has grown at ~11% CAGR over 20-yrs

-

Better priced than peers :

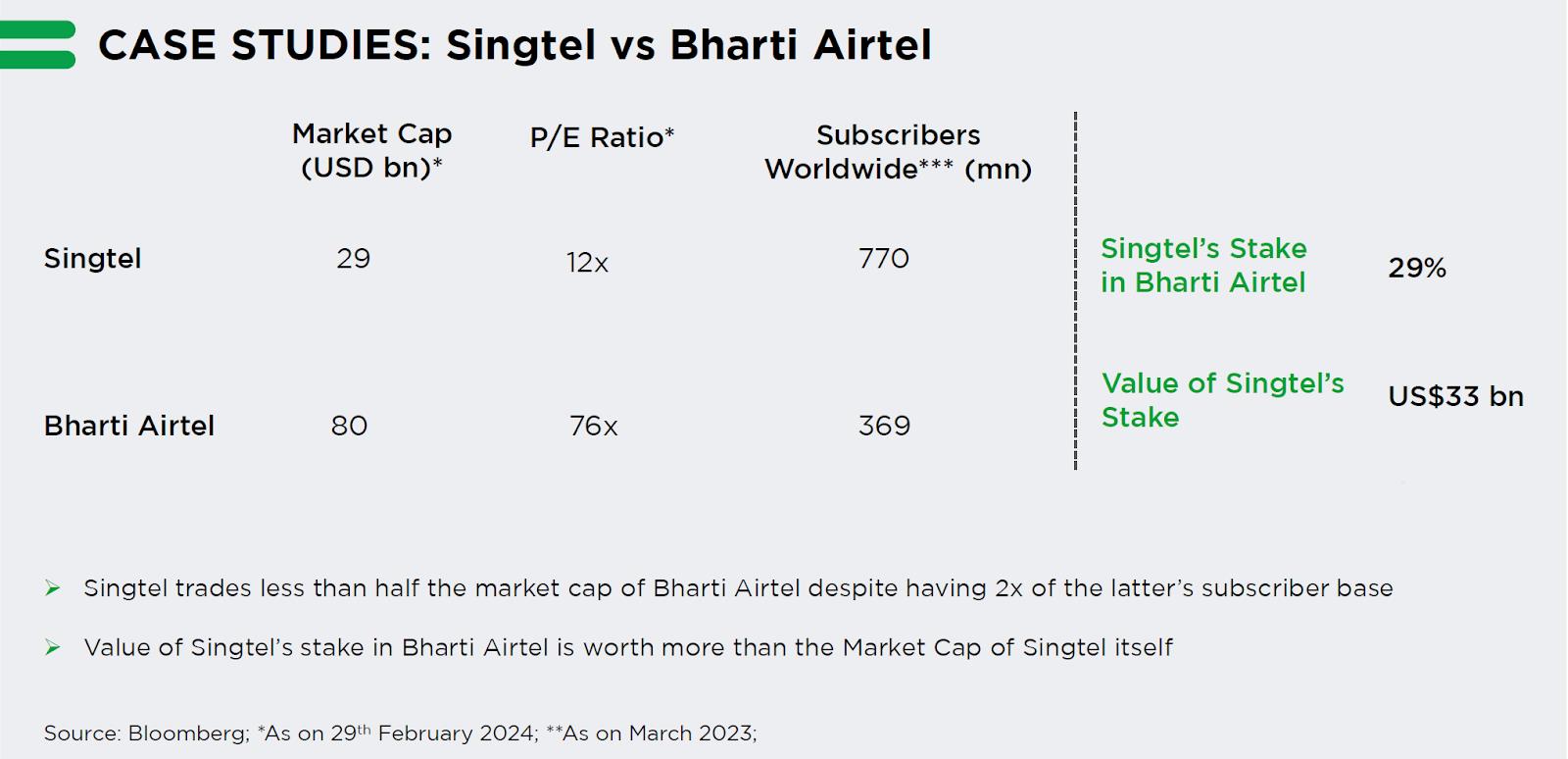

Larger companies, available at lower price, compared to Indian peers.

-

Economic Growth :

China’s GDP growth consistently outpaces many other major economies, making it an attractive investment destination.

-

Sector Diversity :

From technology giants like Alibaba and Tencent to rapidly expanding healthcare and green energy sectors, the market offers diverse investment options.

-

Global Market Integration :

With initiatives like the Stock Connect program, investing in China stocks has become more accessible for global investors.

How to Invest in China Stock Market from India

Investing in the China stock market from India requires navigating a few key steps:

1. Indirect Investment Through International Equity Funds

International equity funds provide a hassle-free way to gain exposure to Chinese stocks. Leading funds like Aequitas International Equity Funds invest in global markets, including China. These funds are managed by experts, offering diversification and reduced risk.

2. Open a Brokerage Account

Choose a brokerage platform that provides access to international markets, including the Shanghai or Shenzhen stock exchanges. Look for platforms offering ease of use and competitive fees.

3. Invest via ETFs (Exchange-Traded Funds)

ETFs focused on China stocks are a popular option for Indian investors. They allow you to invest in a basket of Chinese companies with lower costs compared to direct stock trading.

4. Comply with Regulatory Guidelines

- Liberalized Remittance Scheme (LRS): Indian investors can remit up to $250,000 per financial year for overseas investments.

- Tax Implications: Gains from international investments are taxed as per Indian laws, so consult a financial advisor.

Benefits of Investing in China Stock Market

Understanding the benefits can strengthen your decision to explore this market:

-

High Growth Potential:

China is a leader in industries like e-commerce, AI, and renewable energy, offering long-term growth.

-

Currency Diversification :

Investments in Chinese yuan provide a hedge against rupee depreciation.

-

Global Exposure:

China stocks add geographical diversity to your portfolio, reducing reliance on Indian markets.

Should You Invest in China Now in 2024?

The year 2024 presents unique investment opportunities and challenges for investing in China.

-

Positive Outlook:

Economic reforms and government support for high-growth industries enhance the appeal of China stock market investing.

-

Geopolitical Risks :

Trade tensions and regulatory changes are factors to monitor closely.

-

Expert Advice:

Opt for professional portfolio management through the best international equity funds in India, such as those offered by Aequitas.

Pros and Cons of Investing in China

Pros

- Access to one of the world’s fastest-growing economies.

- Exposure to innovative industries like EVs and biotechnology.

- Favorable valuation of Chinese stocks compared to developed markets.

Cons

- Regulatory uncertainty in the Chinese market.

- Currency risks due to yuan fluctuations.

- Political tensions impacting investor confidence.

Conclusion

Investing in China stocks from India can be a strategic move for portfolio diversification and growth. Whether you choose direct trading, ETFs, or international equity funds, staying informed and understanding the risks are crucial. To streamline the process, explore trusted platforms like Aequitas, which specialize in offering access to the best international equity funds in India.