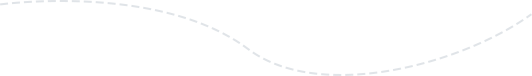

Multibagger quotient: 37x

Apar Industries Ltd

Apar Industries Ltd. is a leading Indian conglomerate, specializing in the production of conductors, transformer oils, and power and telecom cables.

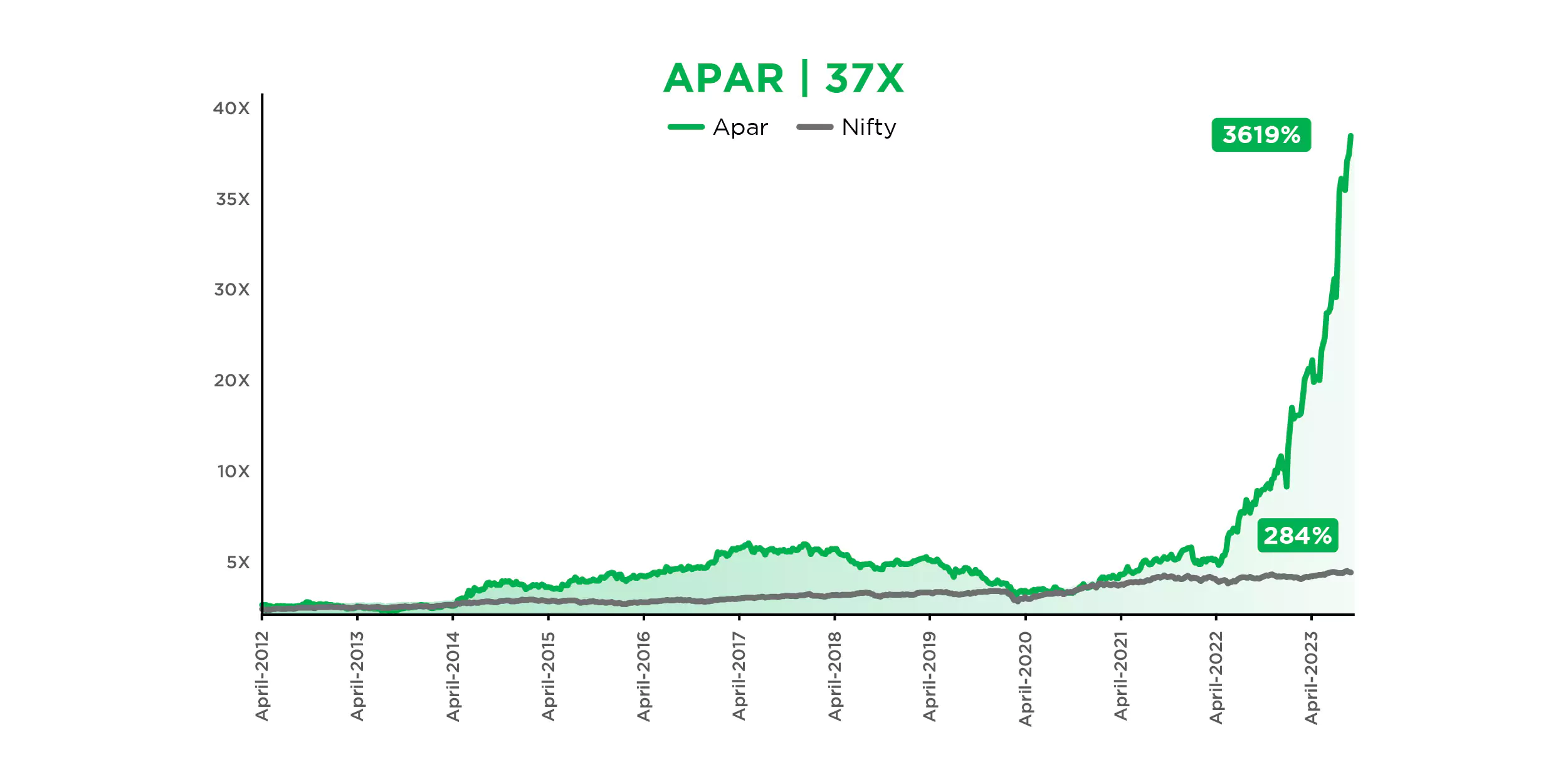

Avanti Feeds Limited

Avanti Feeds Ltd. is a prominent Indian aquaculture company that specializes in shrimp and prawn processing. It is known for its quality seafood products and has a significant presence in the global seafood industry.

-

Multibagger quotient: 120x

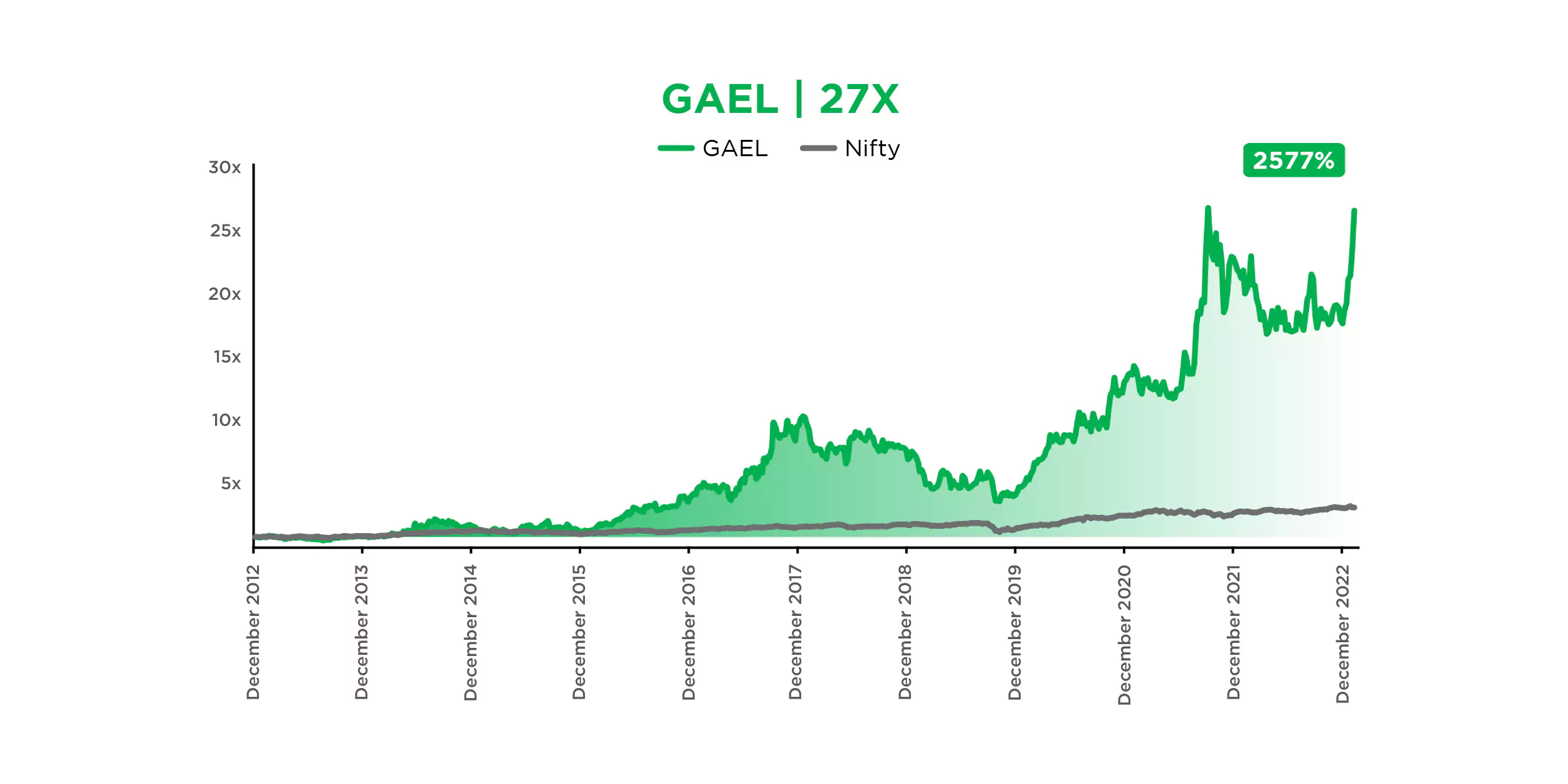

GAEL

Gujarat Ambuja Exports Ltd. specializes in the export of agricultural products, including spices, seeds, and other food items, and is known for its international market presence and quality products.

-

Multibagger quotient: 27x

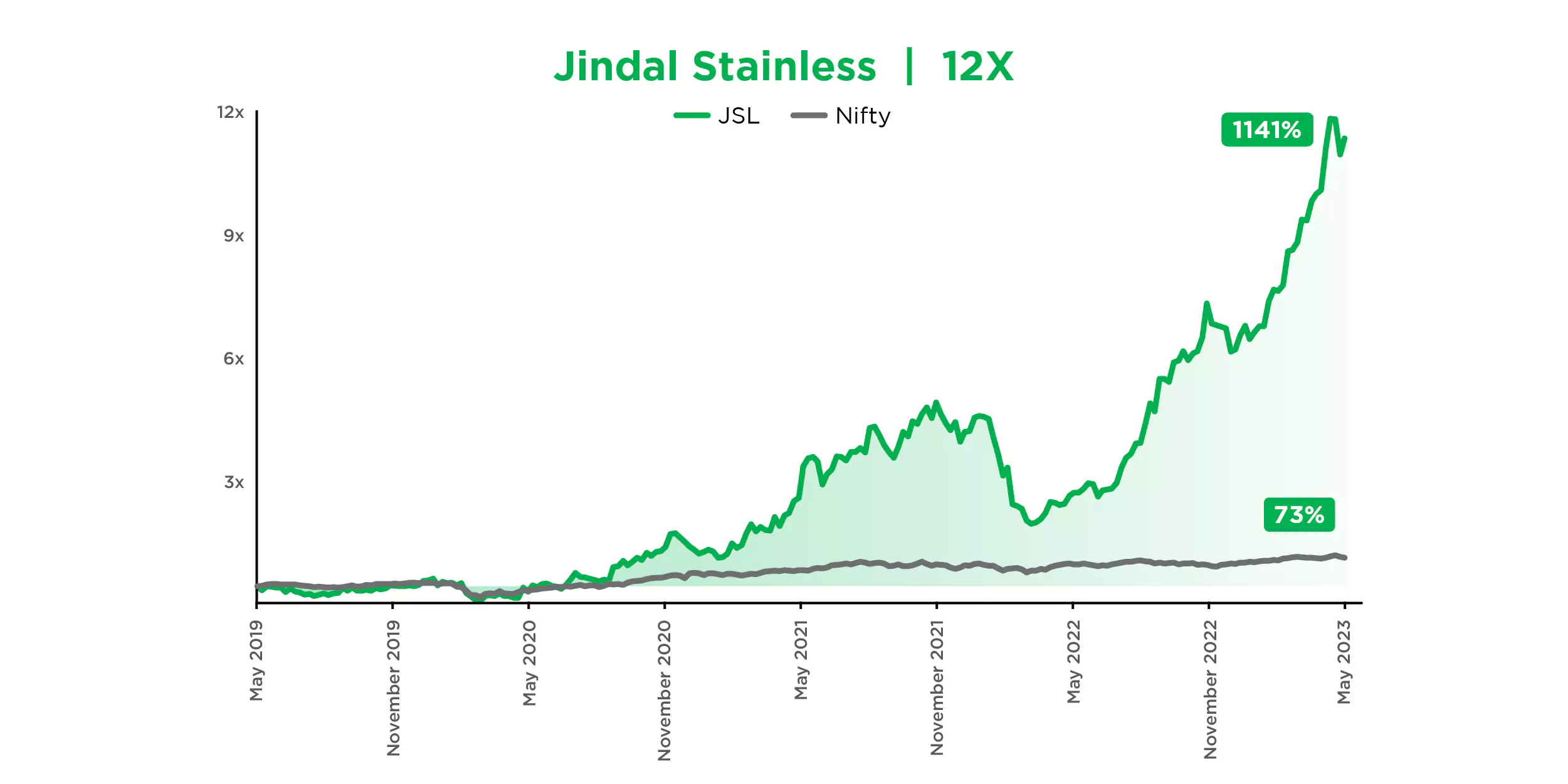

JSL

Jindal Stainless Ltd. is one of India's largest stainless-steel manufacturers and a leading global player, renowned for its high-quality stainless-steel products.

-

Multibagger quotient: 12x

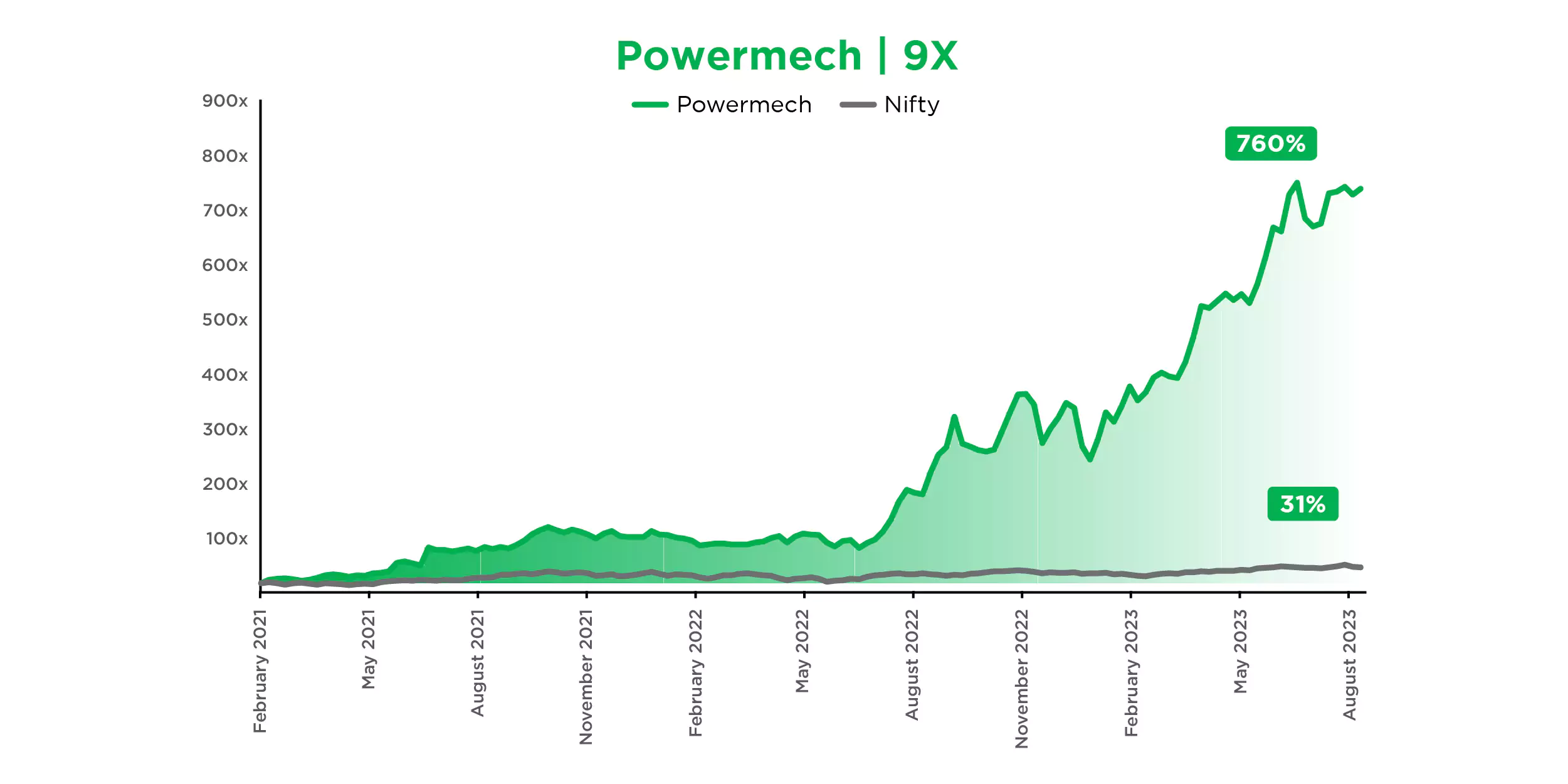

PowerMech

Power Mech Projects Ltd. is a leading Indian infrastructure company specializing in the execution of power projects, industrial boilers, and balance of plant works.

-

Multibagger quotient: 9x